It’s time for another LC|NYC Market update! I’m sure you’ve all heard the news about the unexpectedly large rate cut from the Fed last week, and we’ll get to that. Mortgage rates fell nearly an entire percentage point in the weeks leading up to the Fed’s September 18th meeting. Uncertainty around the prospect of a cut finally seemed inevitable. Remember, the Fed hinted at simply wanting to cut rates in December 2023. Despite their desire to cut, they didn’t see the data they wanted to until much more recently. Now that they have seen their desired results and acted accordingly, we are hopeful that controlled inflation and the can’t- come-soon-enough end of the Election cycle will provide for more stability in our markets.

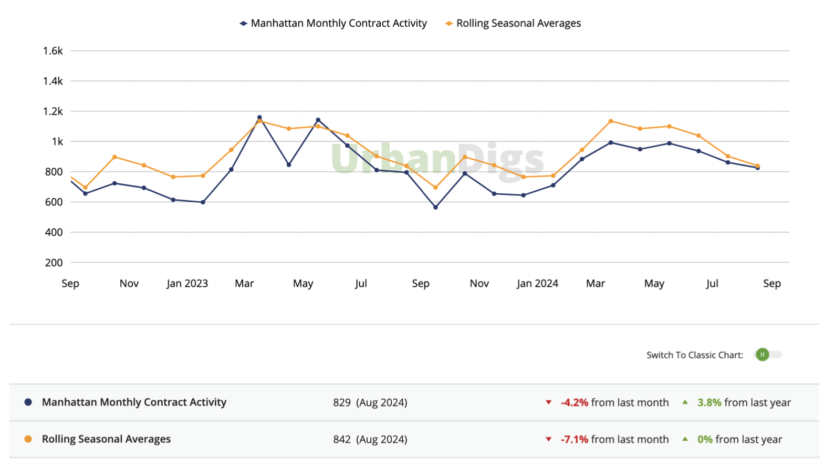

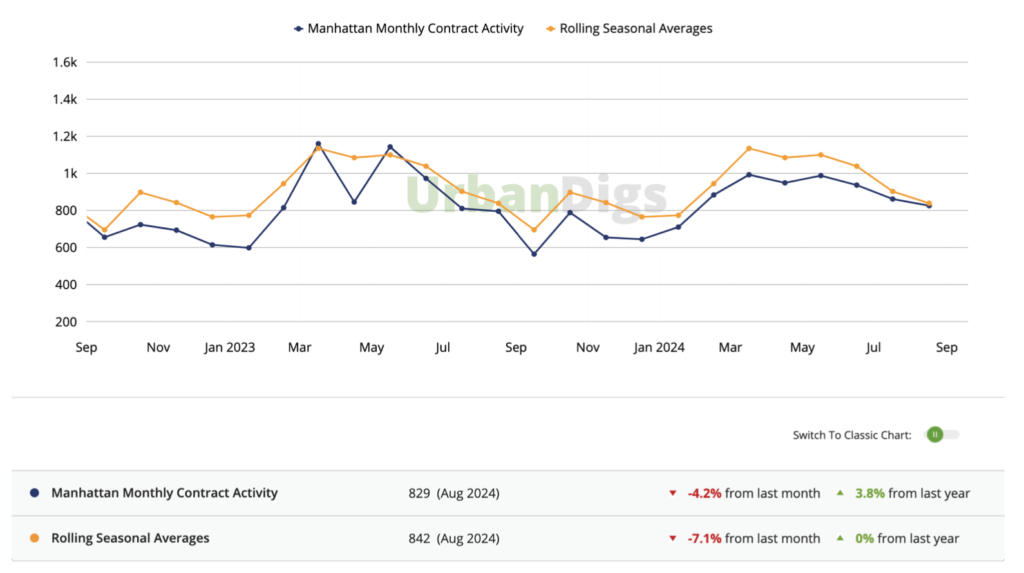

Demand was slower than usual this Spring season, though the Summer has been surprisingly strong, and closer to the seasonal averages than we would have expected based on the Spring. In March & April, contract activity was off the seasonal average about 8-9%, whereas in August it was almost equal. As you can see, in 22 of the last 24 months Contract Activity was below the seasonal average. This increase in demand can likely be attributed to the declining mortgage rates in the weeks leading up to the Fed’s rate cut.

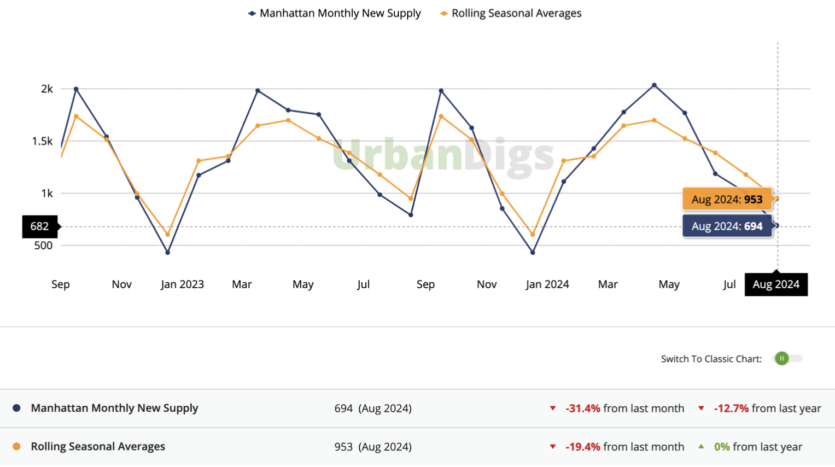

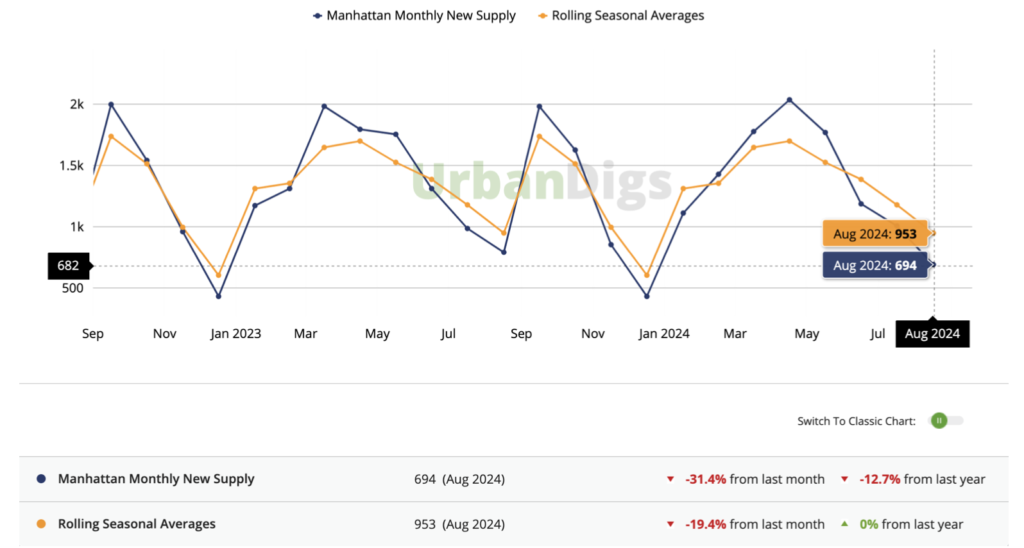

On the supply side, new supply was up over the yearly averages in the Spring, but that tightened over the end of the Summer. The increase in demand, along with typical seasonal drops and below average listing activity has caused supply to dip well below the seasonal average.

All of this points to a clear point: buy-side leverage is beginning to fade. Our next big macro- economic hurdle to pass is the Presidential Election. We know that election years tend to mute a bit of the Fall season in the Manhattan market. We also believe there has been pent up demand building for quite some time due to the high mortgage rates, so our hope is that the Fall market will be longer than it typically is, in light of the rate cuts and removing the uncertainty that comes with an election year.

We were encouraged by the Fed Chairman Powell’s notes on the rate cut, and also encouraged by the 50 basis points instead of the expected 25. The Fed believes the economy is healthy and, most importantly, that they have gotten a solid handle on the inflation that appeared post COVID. Our markets do best when things are stable, and we are hopeful that as the market trends shift back into neutral territory, we will see macroeconomic factors continue to stabilize.

So, is the uncertainty dissipating? Our answer is yes!

Word to Sellers: While the news about the interest rates is welcomed with open arms, the Fed rate cuts do not create instant change in our market. We have been in a buyer’s market for nearly two full years now. The trends we are seeing indicate that the depth of that buyer’s market is receding, so for now, we are recovering into territory that is neutral. This is still better than it has been, but we are nowhere the conditions of recent peak markets like Q4 2021/Q1 2022, or the exuberant 2015/2016 market peak. If you’re selling this Fall, aspirational “let’s- test-the-market” prices are not the way to go. If you think you’ve overshot the market, make your adjustments decisively and early. The Fall season is typically a short one, from mid- September until about Thanksgiving. While we believe the season may go “longer” this year due to the election, we don’t recommend sitting on prices that aren’t getting you the activity you want. If you’re thinking of listing this season, or in the Spring, give us a call for your free consultation!

Word to Buyers: This is still a great time to buy if you can find an apartment you want and can afford. The Summer provided some opportunities, but lack of desperate sellers and combined with seasonally declining inventory cut that window for leverage a little short. Over the past few

weeks, leverage has shifted back toward the sell side, so scoring a Manhattan “deal of the century” will likely be more difficult. The overall negotiability in Manhattan right now is at 4%. This suggests a tightening marketplace as sellers either go off-market to wait another season or tap the red-hot rental market for a stop-gap measure to wait for a better listing environment. If you have a deal in your grasp, take it. Don’t get too greedy and let a good deal slip away. Remember, you’re buying an asset for the longer term in a market that has been underperforming relative to outside markets for years. As 2025 rolls into view and election and mortgage rate uncertainty fade into our memories, sidelined buyer interest could re-ignite leaving you in a more difficult position.